Top Stories

Brisbane Just Got Better - We’re Now Open Saturdays!

July 4, 2025

Brisbane's Best Bullion Deals

June 12, 2025

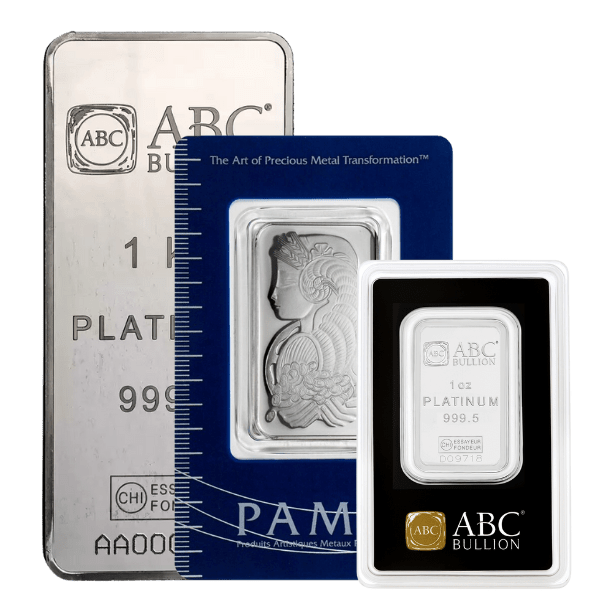

Buy and Sell Platinum Bullion in Brisbane

May 26, 2025

Gold Prices Hit Record Highs – Why Now is the Best Time to Sell in Brisbane

April 23, 2025

In 2025, gold prices have reached record-breaking highs, recently surging past $5,000 AUD per ounce. This historic rally has taken place amid ongoing global uncertainty, inflation fears, and increasing demand from both central...

Sell Gold This Australia Day 2025

January 24, 2025

Australia Day is just around the corner, and while many will be enjoying barbecues and beach trips, we’re here to help you make the most of the long weekend in another way—by offering...

Selling Gold in 2025: Best Destination for Highest Prices

January 2, 2025

2025 is shaping up to be a fantastic year for selling gold, with market prices holding strong and demand for precious metals remaining high. If you’re in Brisbane and looking to cash in...

Get the Best Price for Your Gold This Christmas

December 11, 2024

The holiday season is upon us, and while Christmas is a time for joy and celebration, it can also bring financial pressure. From buying gifts to hosting festive meals, the cost of living...

Now Open Until 5 PM – More Time to Sell Gold and Silver

November 29, 2024

Great news for everyone interested in selling gold or silver! Brisbane Gold Brokers is now open Monday to Friday until 5 PM, giving you even more time to turn your unwanted gold and...